@MumVeng said:

@icomanman said:

@Captain_A said:

i did this.

Skills assessment lng no rsea

Thanks @Captain_A. Yan nga yung point ko; although naiitindihan ko yung impact ng RSEA.

@haringkingking yes, I'm done with the RSEA.

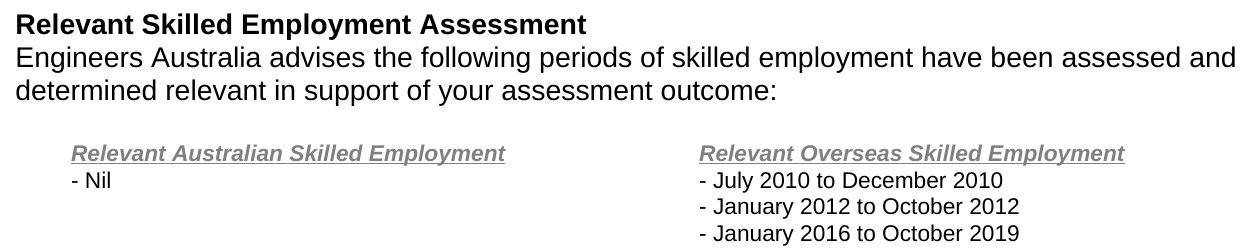

From July 2010 to Oct 2012, isang employer lang ako, pero since matagal na, hindi ko nahanap yong ITR ko ng 2011 (na hiningi nila) so hindi na credit entire 2011.

Then after that, self-employed na ko with complete tax records and client references. Yung kaso from 2014 to 2016, hindi tinanggap ng former supervisor ko yung letter na ginawa ko with the list of duties; although nag bigay sya ng sarili nya endorsement, without the detailed list nga lang. So yan yung iniisip ko: Kailangan ba ni DHA yung detalye ng role mo? Alam nyo naman dito sa pinas, usually standard certificate of employment, title and period lang naka lagay, unless i request mo yung detalyado.

Eto:

Bakit naman po hindi tinanggap ni former supervisor mo? Grabe naman. Baka po pwede mo i-escalate sa manager or even sa HR. Most likely HR keeps record of your JOB OFFER letter. Baka po pwede uli kayo magrequest formally and then CC to your manager, HR manager.

Whether you ask for a review with EA or not, in the end po, hihingi pa din ang DHA ng documents to support your claim of years of experience. Kaya po no choice kayo but to really get them ready.

Kung wala pong ITR, SSS contri po ay pwede. (Page 28, MSA Booklet)

We are dealing with the government so solid po dapat ang paperwork natin.

Thanks @MumVeng.

Clarify ko lang po, meron po ako letters regarding doon sa period, as I've mentioned, nag bigay sya ng sarili nya endorsement, 1 formal letter, statement via email. Ok naman sana. But if you read yung requirements ng EA, kailangan don yung "at least 5 main duties and responsibilities", yan yung hindi naka lagay doon.

Re SSS, nag bigay po ako. The assessor specifically asked for the ITR. Although may pay slip naman din ako. Iba rin talaga.

So looking doon sa online EOI form, sa tingin nyo ba sasabihin nilang nag "over claim" ka kung nilagay mo doon yung employment period? Meron naman akong letters and tax records; wala lang talagang list of duties. Sa ngayon, hindi ko tuloy nilagay yon sa EOI ko. Pero iniisip ko parang walang sense kung hindi ko ilagay kasi totoo naman yung employment period na yon. Nag tanong na ko sa isang agent, iwas pusoy din naman ang sagot nya: malalaman daw pag nag pasa na sa DHA...something na alam naman natin lahat siguro.

@icomanman said:

@MumVeng said:

@icomanman said:

@Captain_A said:

i did this.

Skills assessment lng no rsea

Thanks @Captain_A. Yan nga yung point ko; although naiitindihan ko yung impact ng RSEA.

@haringkingking yes, I'm done with the RSEA.

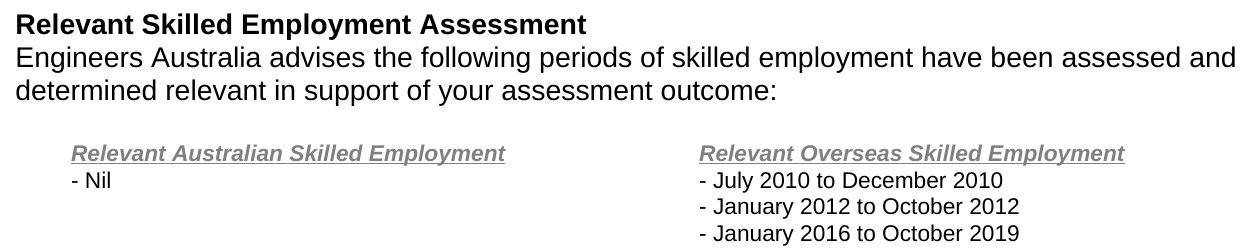

From July 2010 to Oct 2012, isang employer lang ako, pero since matagal na, hindi ko nahanap yong ITR ko ng 2011 (na hiningi nila) so hindi na credit entire 2011.

Then after that, self-employed na ko with complete tax records and client references. Yung kaso from 2014 to 2016, hindi tinanggap ng former supervisor ko yung letter na ginawa ko with the list of duties; although nag bigay sya ng sarili nya endorsement, without the detailed list nga lang. So yan yung iniisip ko: Kailangan ba ni DHA yung detalye ng role mo? Alam nyo naman dito sa pinas, usually standard certificate of employment, title and period lang naka lagay, unless i request mo yung detalyado.

Eto:

Bakit naman po hindi tinanggap ni former supervisor mo? Grabe naman. Baka po pwede mo i-escalate sa manager or even sa HR. Most likely HR keeps record of your JOB OFFER letter. Baka po pwede uli kayo magrequest formally and then CC to your manager, HR manager.

Whether you ask for a review with EA or not, in the end po, hihingi pa din ang DHA ng documents to support your claim of years of experience. Kaya po no choice kayo but to really get them ready.

Kung wala pong ITR, SSS contri po ay pwede. (Page 28, MSA Booklet)

We are dealing with the government so solid po dapat ang paperwork natin.

Thanks @MumVeng.

Clarify ko lang po, meron po ako letters regarding doon sa period, as I've mentioned, nag bigay sya ng sarili nya endorsement, 1 formal letter, statement via email. Ok naman sana. But if you read yung requirements ng EA, kailangan don yung "at least 5 main duties and responsibilities", yan yung hindi naka lagay doon.

Re SSS, nag bigay po ako. The assessor specifically asked for the ITR. Although may pay slip naman din ako. Iba rin talaga.

So looking doon sa online EOI form, sa tingin nyo ba sasabihin nilang nag "over claim" ka kung nilagay mo doon yung employment period? Meron naman akong letters and tax records; wala lang talagang list of duties. Sa ngayon, hindi ko tuloy nilagay yon sa EOI ko. Pero iniisip ko parang walang sense kung hindi ko ilagay kasi totoo naman yung employment period na yon. Nag tanong na ko sa isang agent, iwas pusoy din naman ang sagot nya: malalaman daw pag nag pasa na sa DHA...something na alam naman natin lahat siguro.