Hello,

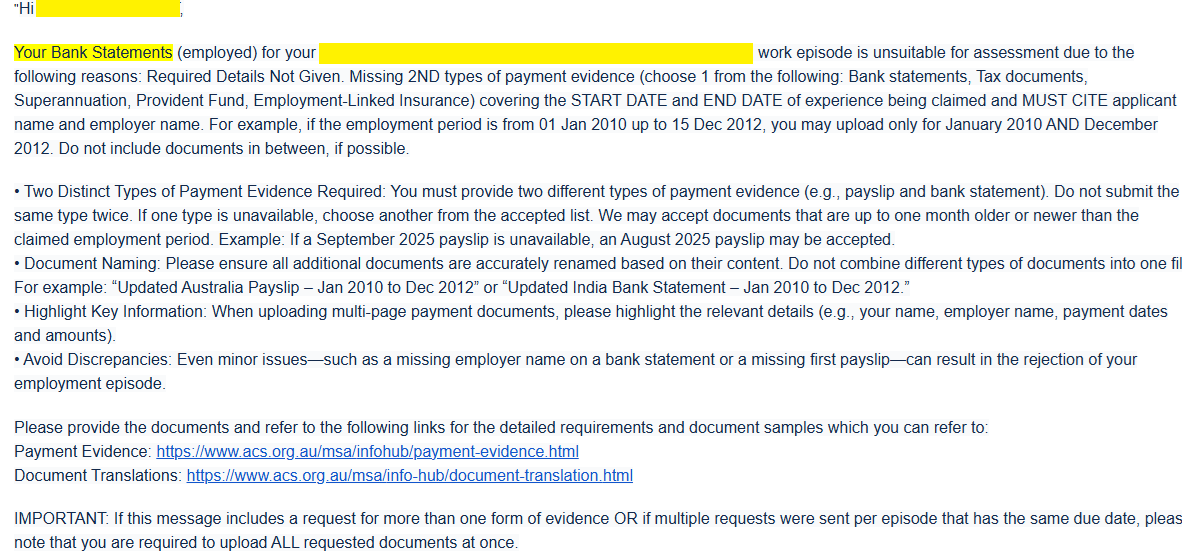

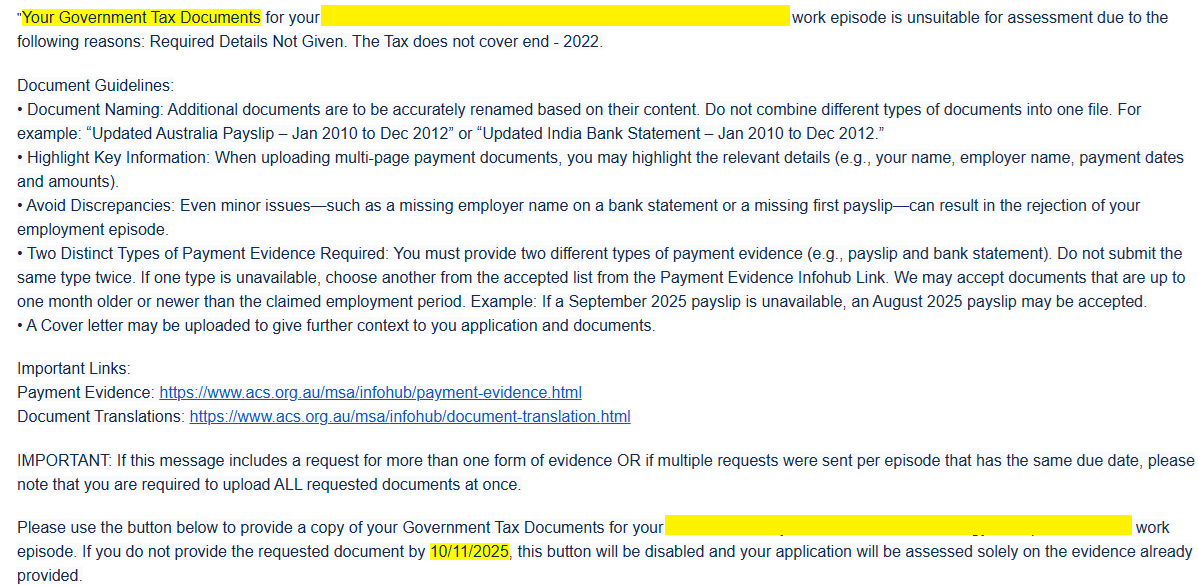

Need ko po sana guidance regarding sa feedback ni ACS sa docs na nasubmit ko (with the help of an agency). Medyo nabibitinan ako sa assistance na ginagawa nila para maiwasan na po sana yung back and forth ng submission ng docs for assessment.

Question 1: Paano po kung yung pinakaunang payslip ay walang letterhead ng company namin (startup) when I started August 2022 at third party yung payroll namin? Ano po ang pwede maging additional evidence na pwede ko isubmit? Recently lang po kasi naghire ng third party payroll system na pwede na ako maggenerate ng payslip na may letterhead na ng company.

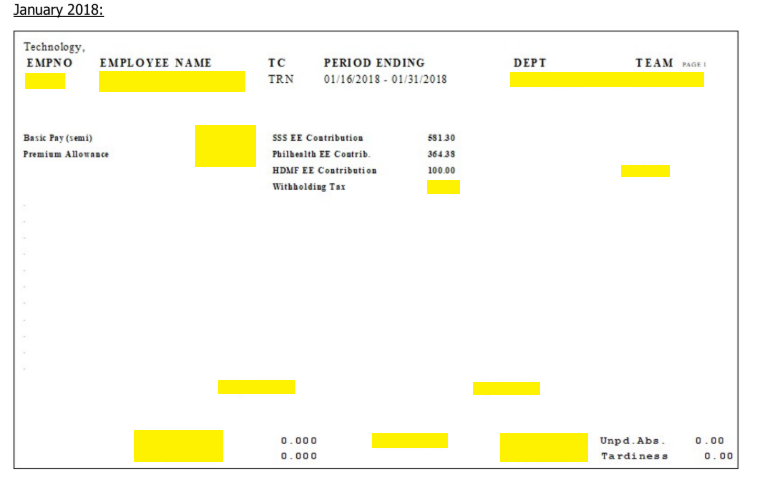

Same scenario po sa previous employer ko from January 2018-January 2020 ito yung sample payslip na sinend sa akin ng HR when I requested for COE:

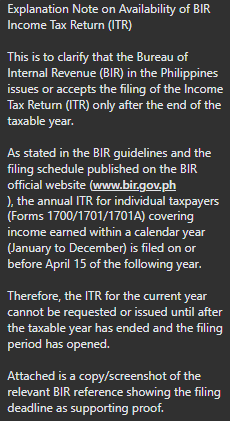

Question 2: Kailangan ko pa po ba gumawa ng letter proving na sa next year pa ako makakapagsubmit ng ITR for 2025 kasi hindi pa naman tapos ang taon at next year pa naman talaga ang filing for 2025 sa BIR?

[Your Name]

[Your Address]

[Email Address]

[Date]

To:

The Australian Computer Society (ACS)

[Address or “Through Online Portal,” if applicable]

Subject: Explanation on Availability of BIR Income Tax Return (ITR)

Dear Sir/Madam,

This letter is to explain that in the Philippines, the Bureau of Internal Revenue (BIR) issues or accepts the filing of the Income Tax Return (ITR) only after the end of the taxable year.

Question: Ito po yung previous employer ko last 2022 before I joined my current employer last August 2022, ano pong docs bukod sa ITR na nasubmit ko from this previous employer ang pwede ko isubmit? Nagsubmit na rin po ako ng first and last payslip.

Salamat po in advance sa help at suggestions.