Hey Everyone! Admin here, It's a bit overdue but I will be migrating our forum site to a new platform for better security. I will take out all the ads as well as these pesky spammers. Please expect a bit of issues here and there, and will slowly move the features to the new one. Don't worry we are very much alive and will be alive as long as I'm here :)

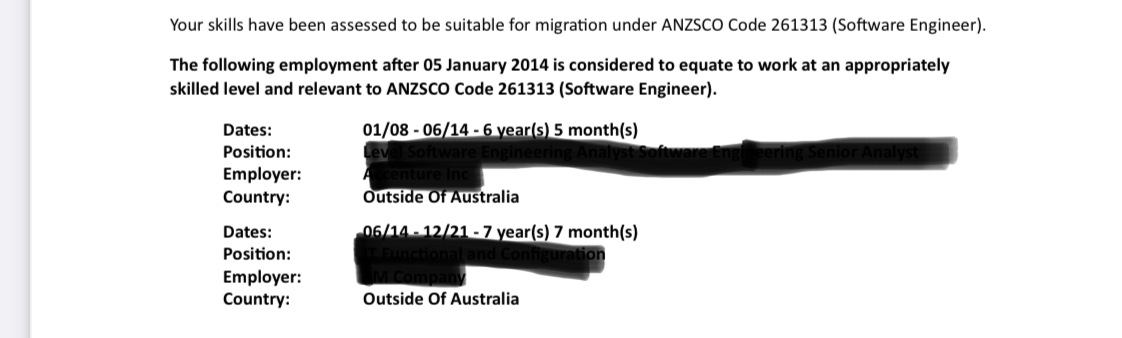

Claiming beyond 10 years experience for ACS

LATEST 10 ACTIVE DISCUSSION THREAD

most recent by smashromasa

most recent by opensourceemis

📢 Community Update - Forum Platform Migration

most recent by opensourceemis

most recent by codexa174

most recent by QungQuWeiLah

most recent by Jacraye

General Skilled Immigration Visa - Step By Step Process

most recent by trafalgar

Engineers Australia Skills Assessment

most recent by MiEn2Straya

most recent by Admin

Welcome to Pinoy AU Community!

The longest running Pinoy-Australian Forum site in the history. We are connecting Pinoys "in" and "to" Australia since 2010! If you want to join in, click one of these buttons!

Quick Links

Categories

- 16.9K All Categories

- 3.1K Working and skilled visas

- 717 Regional Sponsored Migration

- 737 Family and Partner Visas

- 558 Employer Sponsored Visas

- 1.5K Study and Training Visa

- 1.1K Visitor - Tourist Visa

- 341 IELTS, PTE and OET Topics

- 277 Migration Agent

- 1.2K Other Migration Topic

- 2.3K Ask A Migration Agent [FREE Consultation]

- 1.8K ReachOut Migration

- 1.6K Services

- 308 Visa Consort

- 113 Skilled Migrant Visa

- 159 Migration Service

- 232 World2Australia

- 91 Partner Visa

- 40 Student Visa

- 2.7K General Topics on Life in Australia

- 1.5K General

- 51 Taste of Australia

- 45 EB's and Get Together

- 135 Family Matters

- 395 Working in Australia

- 157 Health Care

- 61 Remittance/Exchange Rate

- 68 Hobbies and Activities

- 36 Balikbayan Box

- 95 Other Info Bout OZ

- 3.7K Resident's corner - Latest Happenings, Offerings, in specific State, Suburb, City

- 1.2K New South Wales - Sydney

- 685 Accommodations

- 186 Jobs

- 97 Buy & Sell

- 89 Services

- 15 Shops/Stores/Restaurants

- 854 Victoria - Melbourne

- 475 Accommodations

- 93 Jobs

- 34 Buy & Sell

- 77 Services

- 4 Shops/Stores/Restaurants

- 122 ACT - Canberra

- 55 Accommodations

- 9 Jobs

- 9 Buy & Sell

- 3 Services

- 2 Shops/Stores/Restaurants

- 518 South Australia - Adelaide

- 256 Accommodations

- 32 Jobs

- 42 Buy & Sell

- 36 Services

- 1 Shops/Stores/Restaurants

- 372 Western Australia - Perth

- 134 Accommodations

- 50 Jobs

- 28 Buy & Sell

- 25 Services

- 8 Shops/Stores/Restaurants

- 298 Queensland - Brisbane

- 100 Accommodations

- 13 Jobs

- 90 Services

- 5 Buy & Sell

- 1 Shops/Stores/Restaurants

- 67 Northern Territory- Darwin

- 8 Accommodations

- 11 Jobs

- 5 Buy & Sell

- 3 Services

- 1 Shops/Stores/Restaurants

- 18 Other States, City, Suburb, Location

- 2K Free Ads - Section

- 1.5K Housing & Rentals

- 253 Jobs-Seeking & Openings

- 77 Goods & Services

- 26 Automotive

- 135 General Ads

- 173 Anything Goes

- 90 Loose talk, Kulitan & off-topic

- 30 Gamers Arena

- 21 Information Tech Thingy

- 22 Suggestions for improvement

- 88 News

- 88 Update

Top Posters

-

cccubic

6

cccubic

6 -

ttr0220

5

ttr0220

5 -

opensourceemis

5

opensourceemis

5 -

Laim

4

Laim

4 -

Admin

4

Admin

4 -

QungQuWeiLah

4

QungQuWeiLah

4 -

trafalgar

4

trafalgar

4 -

deville30

3

deville30

3 -

sambillings

2

sambillings

2 -

charls059

2

Top Active Contributors

-

lunarcat

395

lunarcat

395 -

mathilde9

1094

mathilde9

1094 -

jar0

127

jar0

127 -

Admin

1777

Admin

1777 -

CantThinkAnyUserName

118

CantThinkAnyUserName

118 -

datch29

285

datch29

285 -

baiken

461 -

Jacraye

281

Jacraye

281 -

whimpee

557

whimpee

557 -

silverbullet

280

silverbullet

280

Top Posters

-

lock_code2004

5037

lock_code2004

5037 -

TasBurrfoot

4336

TasBurrfoot

4336 -

batman

3532

batman

3532 -

RheaMARN1171933

2822

RheaMARN1171933

2822 -

Cassey

2812 -

LokiJr

2616

LokiJr

2616 -

danyan2001us

2536

danyan2001us

2536 -

IslanderndCity

2274

IslanderndCity

2274 -

Captain_A

2179

Captain_A

2179 -

se29m

2144

Comments

Posts: 1,045Member, Moderator

Joined: Sep 13, 2019

But it's still best to note, for transparency, that this is NOT always the case to avoid confusion and people being misled.

The more qualifying statement for this is "ACS may deduct years from your experience beyond the 10-year timeline."

DIY all the way. Avoid preachy, know-it-all, and unscrupulous agents AT ALL COSTS!

"We must look for ways to be an active force in our own lives. We must take charge of our own destinies, design a life of substance and truly begin to live our dreams." - Les Brown

261312 (Developer Programmer) - Main | 261111 (ICT Business Analyst) - Wife

189 (95), 190 (100)

2023

14 Nov | BIG MOVE

01 Nov | HIRED | First day of work. Remote working arrangement from SG

--- Trying my luck at job hunting while in Singapore and BM planning on the side ---

19 Apr | Direct Visa Grant | What a journey... JUST GRATEFUL!

2022 - Pandemic Eases Off

17 Nov | Medical Test Clearance

15 Nov | Medical Test

03 Nov | EOI #4, #6 | 189 Withdrawn, 190 NSW Withdrawn

03 Nov | Visa Application | 190 VIC --- THE REAL WAITING GAME BEGINS!!!

31 Oct | ITA | 190 VIC | never thought this day would come!!! T.T good decision to defer NSW nomination.

27 Oct | Pre-ITA | 190 NSW --- sabi nila, when it rains, it pours!!!

26 Oct | Nomination Application | 190 VIC

26 Oct | Pre-ITA | 190 VIC --- one step closer, sa wakas, PADAYON!!!

21 Oct | EOI #4, #5 + ROI, #6 DoE | 189, 190 VIC, 190 NSW

21 Oct | ACS Assessment (Wife) Renewal - Suitable

xx Mar| EOI#1, #2, #3 | 189 Expired, 190 NSW Expired, 190 VIC Expired

2021 - Pandemic Still

25 Sep | ACS Assessment (Main) Renewal - Suitable

01 Feb | EOI#4 DoE | 189

2020 - Pandemic

19 Aug | EOI#1, #2, #3 DoE | 189, 190 NSW, 190 VIC

30 Jul | NAATI CCL Online Test | Result: Passed

09 Mar | PTE (Wife) | Results: L90 R80 S90 W82 (Superior)

19 Feb | PTE (Main) | Results: L90 R83 S90 W82 (Superior)

12 Feb | ACS Assessment (Wife) - Suitable | Expired

2019

24 Oct | ACS Assessment (Main) - Suitable | Expired

2018

--- Tons of research, document collection and other necessary preparations ---

01 Sep | The Beginning | Had the chance to visit Oz, and immediately fell in love with it!

Joined: Mar 10, 2016

What is misleading here? Can is defined as 1.

be able to.

"they can run fast"

2.

be permitted to.

"you can use the phone if you want to"

May is defined as expressing possibility.

"that may be true"

2.

used to ask for or to give permission.

"you may confirm my identity with your Case Officer, if you wish"

It is given that everything claimed is subject to the authority’s discretion. If they find that the qualifying years occurred beyond the 10 years then they are permitted to / can deduct the qualifying years from there. It isn’t a possibility/may because it is a fact that they are able to deduct those years.

ACS can/permitted to deduct the qualifying years beyond the 10 years if they think it is suitable.

The word may is more apt if the topic of the post was claiming work experience in general without knowing the results, ie the work experience beyond the 10 years may be considered by the assessing officer - but the post isn’t referring to that.

The post emphasises on the fact that it is beneficial to claim beyond the 10 years because if the assessor finds it suitable like the example given they will deduct the qualifying years from beyond the 10 years…you can’t use a may verb here as the example provides a fact and not a possibility 😂 I don’t see anything misleading here.

Bottom line is, there is nothing to lose if you claim as far back experience…doing so won’t lead to any negative outcome but rather beneficial. It may not be recognised but at least you’ve put it out there for the assessor to decide.

Speaking of misleading comments, there are a lot of advice/opinions given in this forum where I see potential danger as such can lead to a problematic result. Hence the reason I give my 2 cents of professional knowledge when I see such risks to help out in my own little way. This post alone isn’t misleading for all the reasons mentioned above but rather disheartening for those who have claimed beyond the 10 years work experience but the assessor didn’t consider those as qualifying years.

Posts: 1,045Member, Moderator

Joined: Sep 13, 2019

As disheartening as it is, you cannot deny the fact that this is NOT true for all. True, your example is factual. But it is also FACTUAL that NOT all cases are the same, there go "chance" and "possibility".

So, preach all you want, but for all the same reasons you are "correcting" people, they deserve clearer and encompassing explanations than simply "hearing it from someone in the profession".

DIY all the way. Avoid preachy, know-it-all, and unscrupulous agents AT ALL COSTS!

"We must look for ways to be an active force in our own lives. We must take charge of our own destinies, design a life of substance and truly begin to live our dreams." - Les Brown

261312 (Developer Programmer) - Main | 261111 (ICT Business Analyst) - Wife

189 (95), 190 (100)

2023

14 Nov | BIG MOVE

01 Nov | HIRED | First day of work. Remote working arrangement from SG

--- Trying my luck at job hunting while in Singapore and BM planning on the side ---

19 Apr | Direct Visa Grant | What a journey... JUST GRATEFUL!

2022 - Pandemic Eases Off

17 Nov | Medical Test Clearance

15 Nov | Medical Test

03 Nov | EOI #4, #6 | 189 Withdrawn, 190 NSW Withdrawn

03 Nov | Visa Application | 190 VIC --- THE REAL WAITING GAME BEGINS!!!

31 Oct | ITA | 190 VIC | never thought this day would come!!! T.T good decision to defer NSW nomination.

27 Oct | Pre-ITA | 190 NSW --- sabi nila, when it rains, it pours!!!

26 Oct | Nomination Application | 190 VIC

26 Oct | Pre-ITA | 190 VIC --- one step closer, sa wakas, PADAYON!!!

21 Oct | EOI #4, #5 + ROI, #6 DoE | 189, 190 VIC, 190 NSW

21 Oct | ACS Assessment (Wife) Renewal - Suitable

xx Mar| EOI#1, #2, #3 | 189 Expired, 190 NSW Expired, 190 VIC Expired

2021 - Pandemic Still

25 Sep | ACS Assessment (Main) Renewal - Suitable

01 Feb | EOI#4 DoE | 189

2020 - Pandemic

19 Aug | EOI#1, #2, #3 DoE | 189, 190 NSW, 190 VIC

30 Jul | NAATI CCL Online Test | Result: Passed

09 Mar | PTE (Wife) | Results: L90 R80 S90 W82 (Superior)

19 Feb | PTE (Main) | Results: L90 R83 S90 W82 (Superior)

12 Feb | ACS Assessment (Wife) - Suitable | Expired

2019

24 Oct | ACS Assessment (Main) - Suitable | Expired

2018

--- Tons of research, document collection and other necessary preparations ---

01 Sep | The Beginning | Had the chance to visit Oz, and immediately fell in love with it!

Joined: Mar 10, 2016

I refer back to the example given. I’m not even correcting people on the post, I’m giving an example, a fact on a new discussion created. A post was made and not a comment to which members can ask questions if not clear. Please stay within the topic of the post. Would be good if you are able to clarify what is exactly misleading in reference to the example provided on the post rather than going going off topic.

I also refer to #4 & #5 of the forum’s rules see link below. Please be mindful as otherwise your posts will be deleted again. Thank you.

https://pinoyau.info/plugin/page/rules